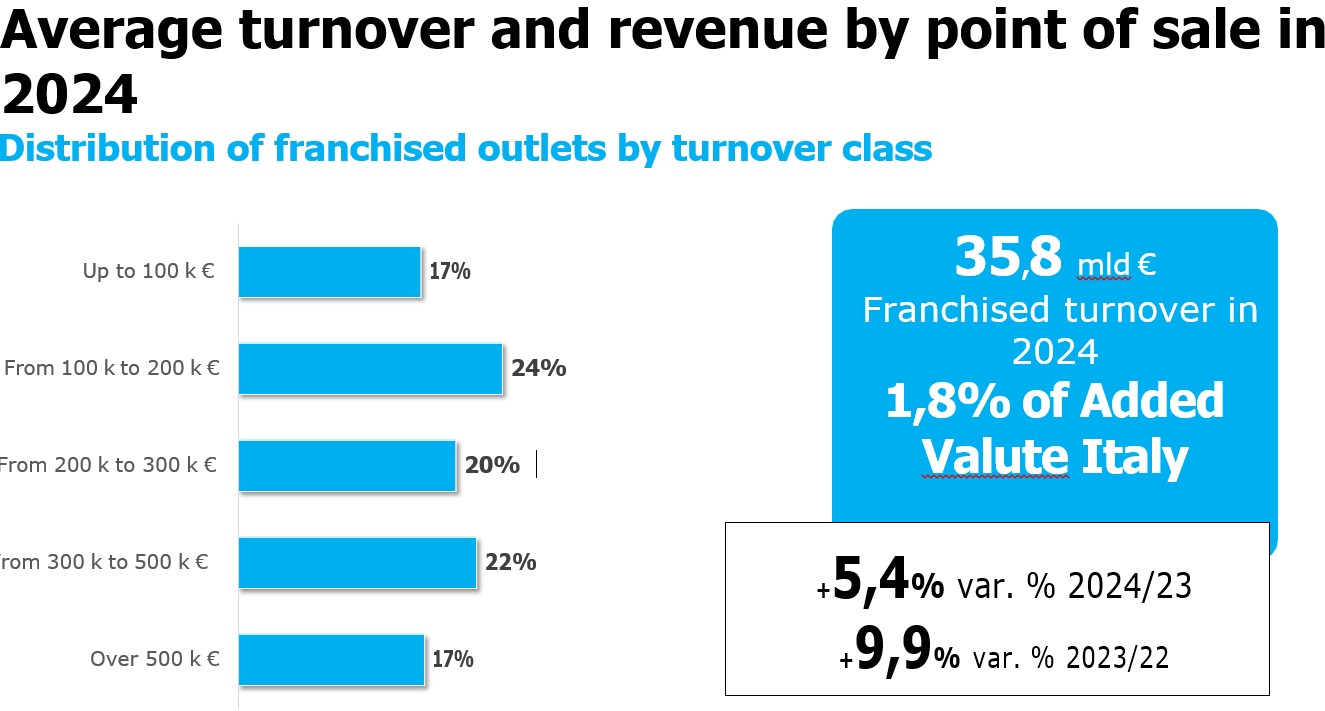

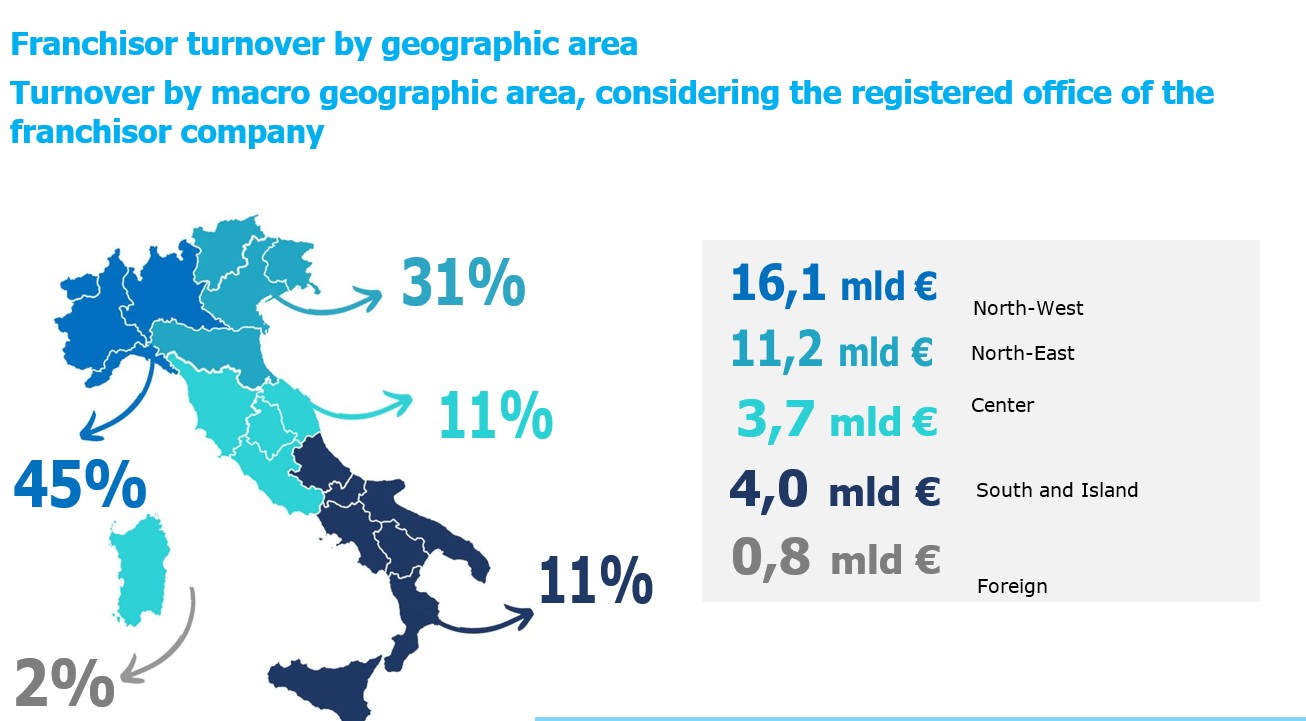

Franchising confirms to be a winning model in Italy: in 2024, franchising turnover reaches €. 35.8 billion, accounting for 1.8% of Italian national value added

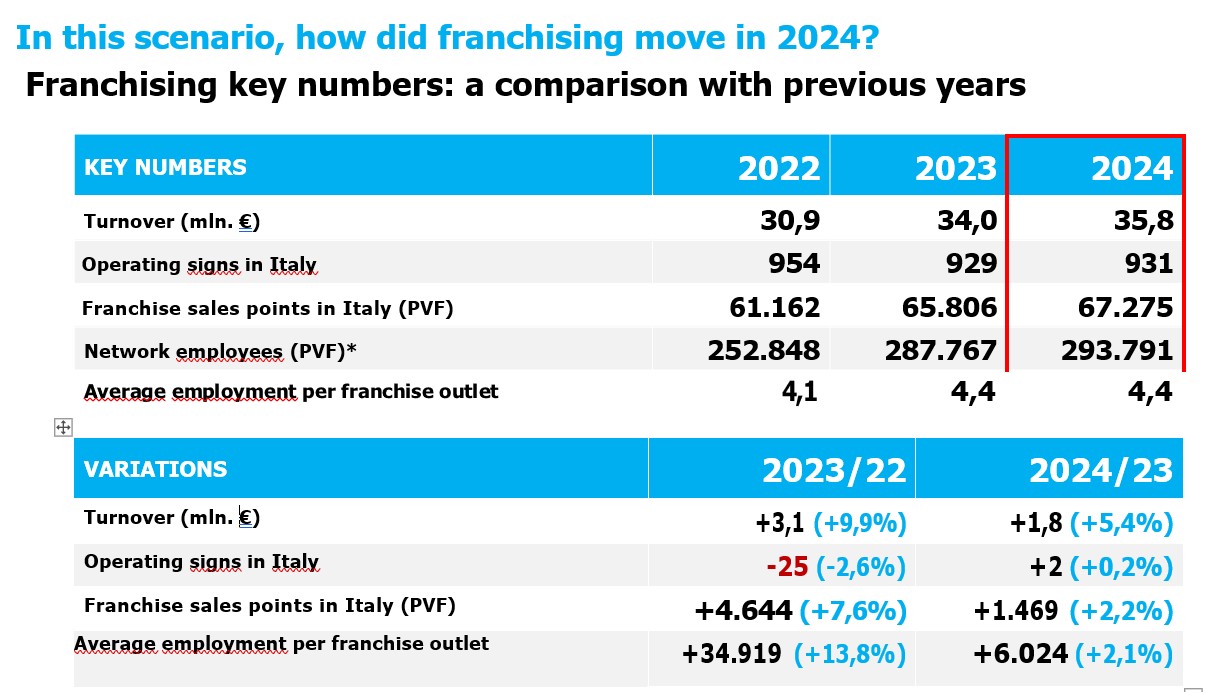

Despite the uncertain economic climate and an international landscape characterized by tariffs and geopolitical tensions, franchising continues to grow in Italy, a sign of the sector’s strong resilience and transformative capacity. In 2024, franchising consolidates its growth trend, closing with a turnover of €. 35.8 billion (+5.4% compared to 2023). This is the snapshot captured by the Assofranchising Italia 2025 Report – Structures, Trends and Scenarios, produced by Nomisma for Assofranchising, the Italian franchising association.

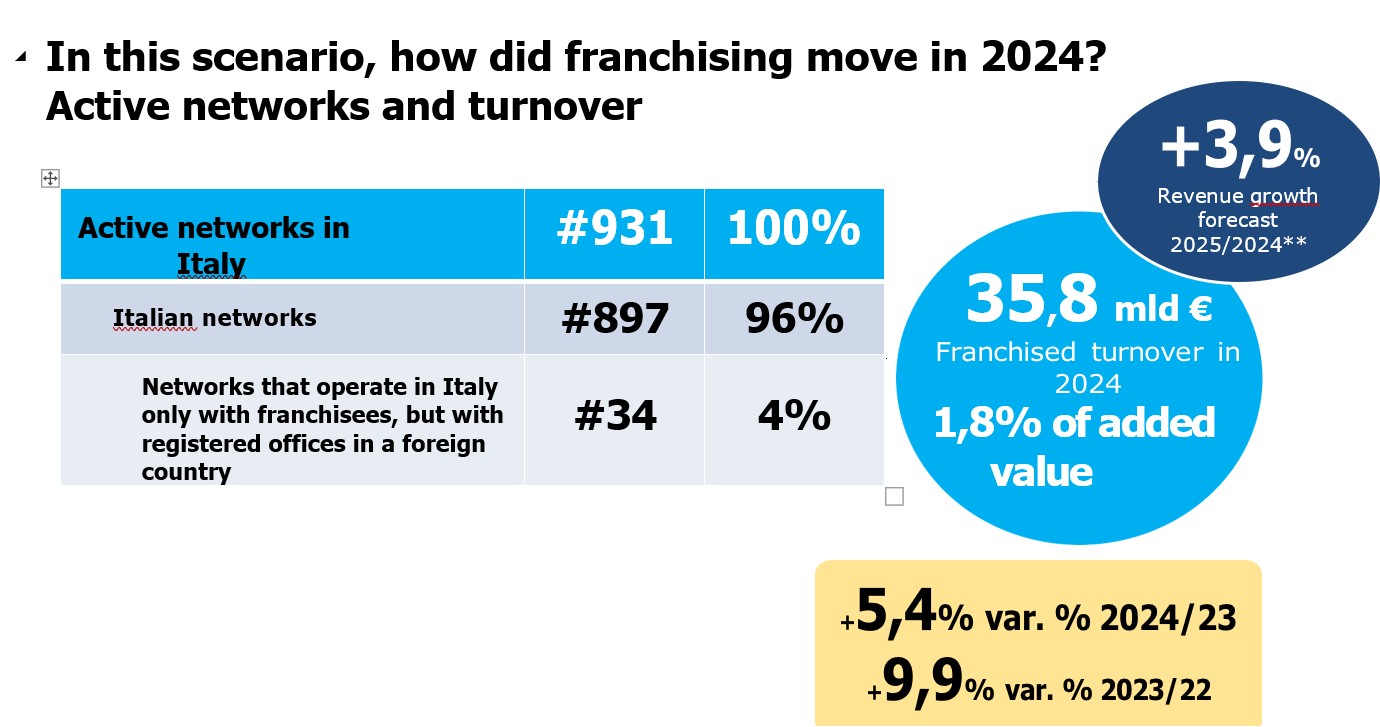

Franchising numbers in Italy- 2024

Despite the uncertain economic climate and an international landscape characterized by tariffs and geopolitical tensions, franchising continues to grow in Italy also in 2024, a sign of the sector’s strong resilience and transformative capacity.

Growth, although slower than in the previous year, is evident across all performance indicators of the franchising sector, which accounts for 1.8% of Italian national added value.

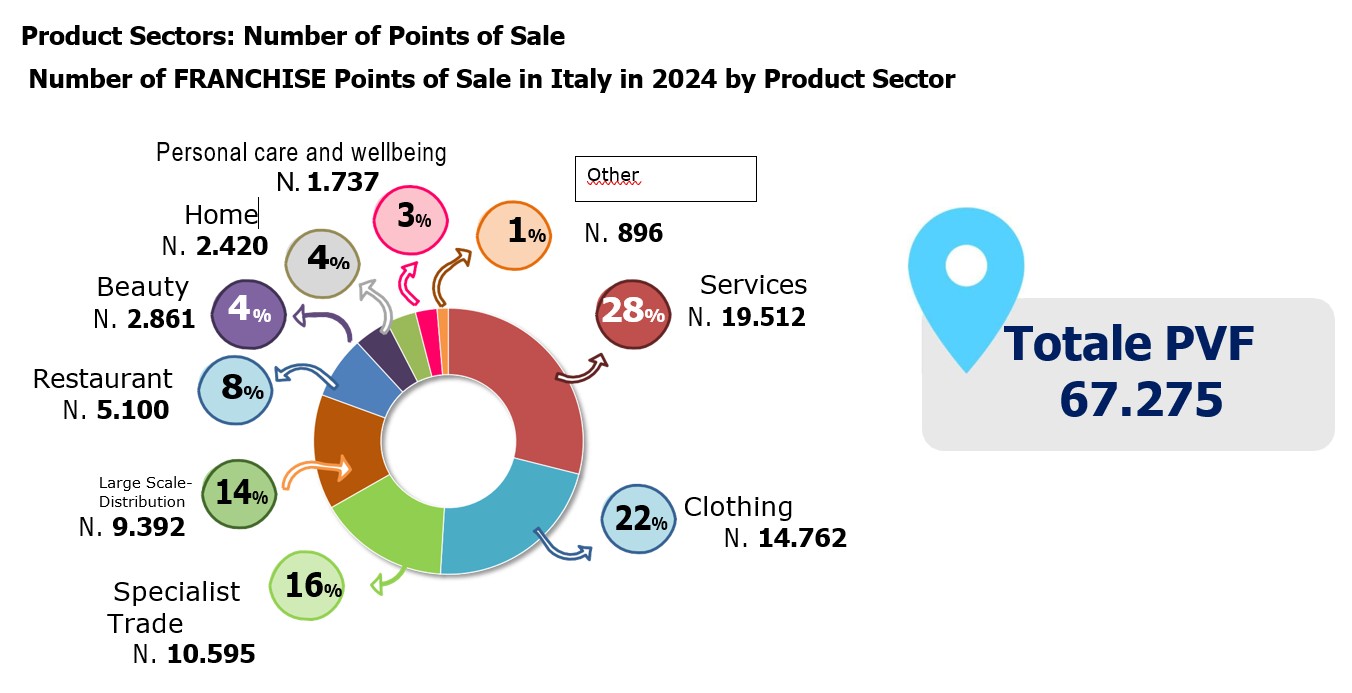

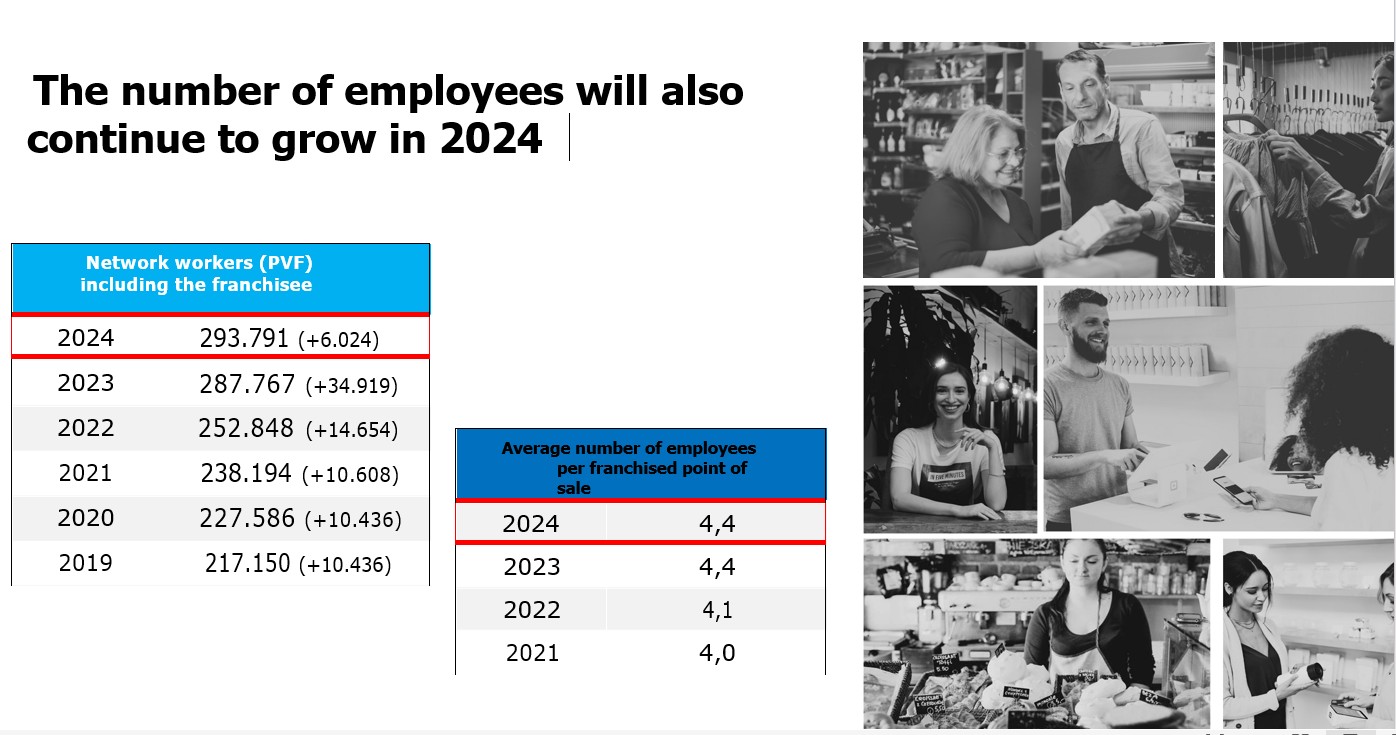

In 2024, the number of franchised stores have increased to 67,275 (+2.2% compared to 2023), as will the number of employees, which will reach 293,791 (+2.1% compared to 2023).

Considering the active networks, the downward trend seen in recent years has been reversed. In 2024, a total of 931 franchises will be operating in Italy (+0.2% compared to 2023).

Considering the turnover generated, the most important product sectors are large-scale retail trade (turnover of €. 12.6 billion), followed by clothing (€. 7.4 billion) and services (€. 6.7 billion). The only sector that hasn’t grown is the home sector, which sees a 1.4% reduction in turnover compared to 2023.

Every euro invested in the franchising sector generates 2.8 euros for the entire national economy, with an overall impact on production value estimated at approximately 94 billion euros.

According to the 2024 Assofranchising Report, the sector achieved a turnover of nearly 34 billion euros, a 9.9% increase compared to the previous year, and a total workforce of 287,767.

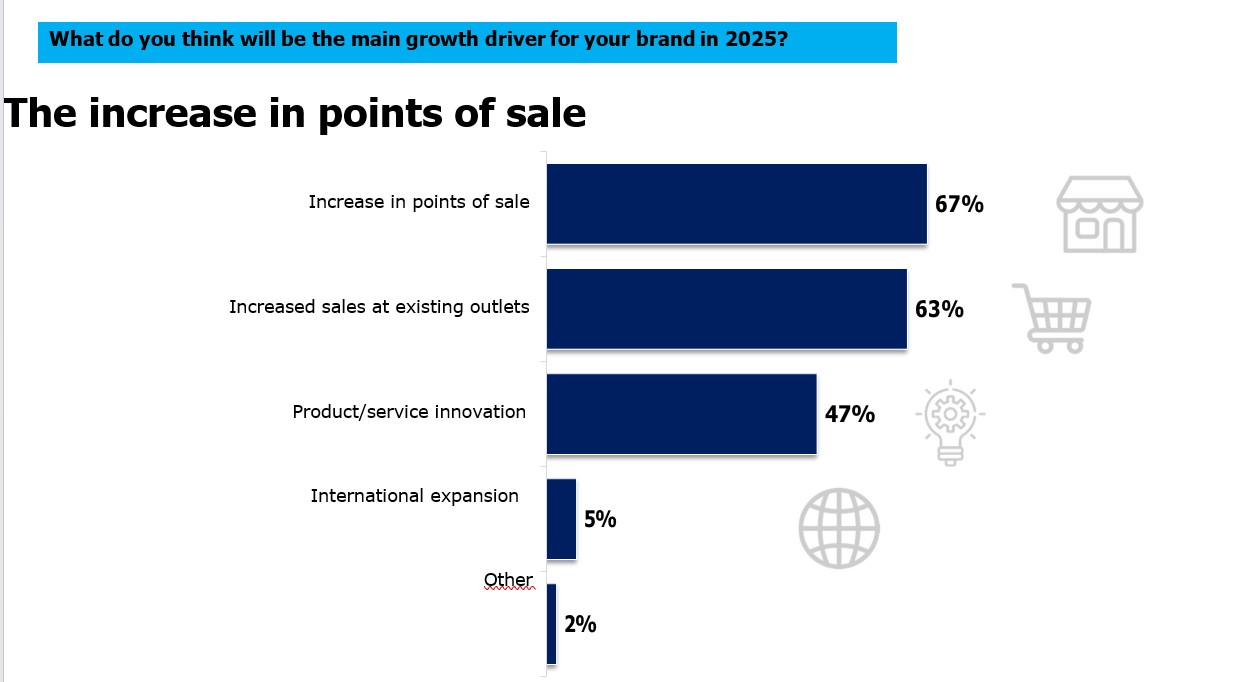

For 2025, overall revenue for the franchising sector is forecast to grow by around 3.9%.

The elements that have characterized such growth are attributable in particular to the investments made to involve new franchisees, in particular by large brands and the creation of new brands. o Finally, the number of operational brands, despite the addition of new players, continues a downward trend that was accentuated in 2020. In 2023, in fact, 25 brands will no longer exist.

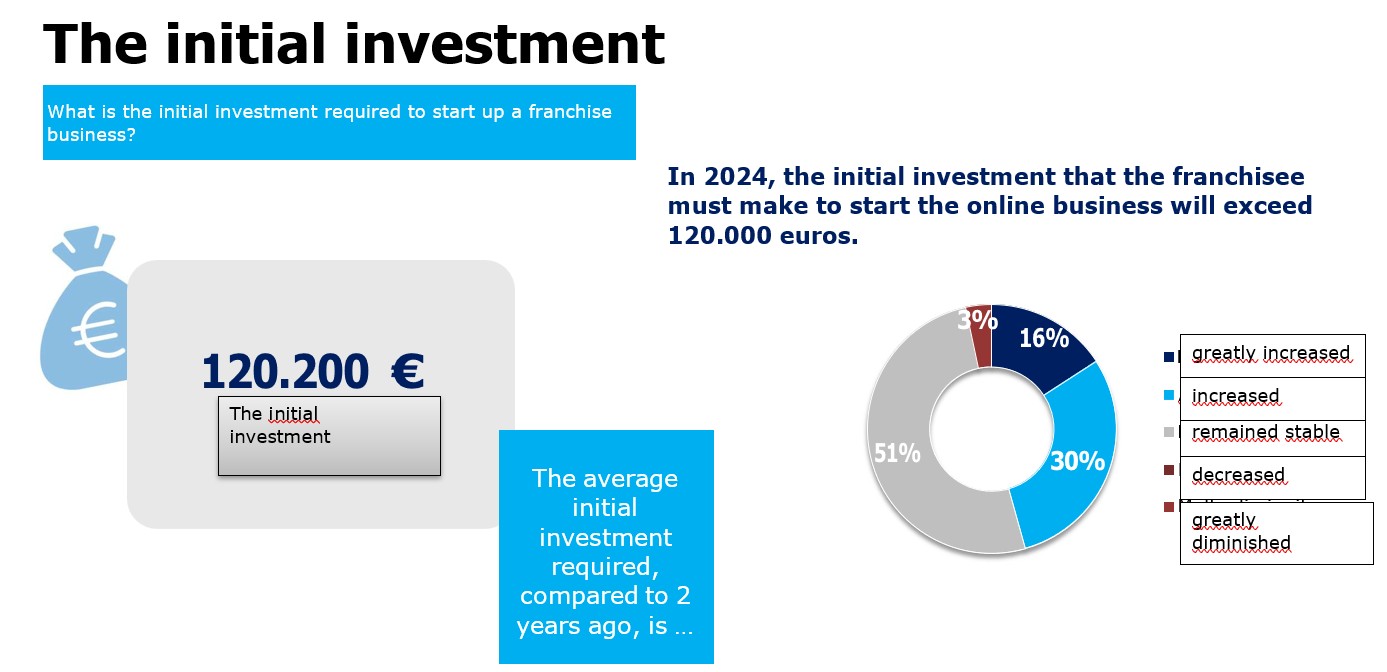

In 2023, the initial investment, which the franchisee must support to undertake the online business, exceeds 110,000 euros. This situation is attributable to a lesser extent to the inflation that characterized the two-year period 2022-2023 and primarily to the inclusion of new brands with more impactful installation activities.

The duration of the contract is a crucial factor on which franchisors and franchisees base their commercial relationship and overall investments in the franchised point of sale. A short duration of agreements reflects a necessarily rapid business model, capable of growing quickly to guarantee a rapid return on investment. In 2022, almost one in two contracts had an average duration of 5 years, while one in four exceeded 6 years. In 2023, there has been an increase in brands that prefer a duration of more than 5 years.

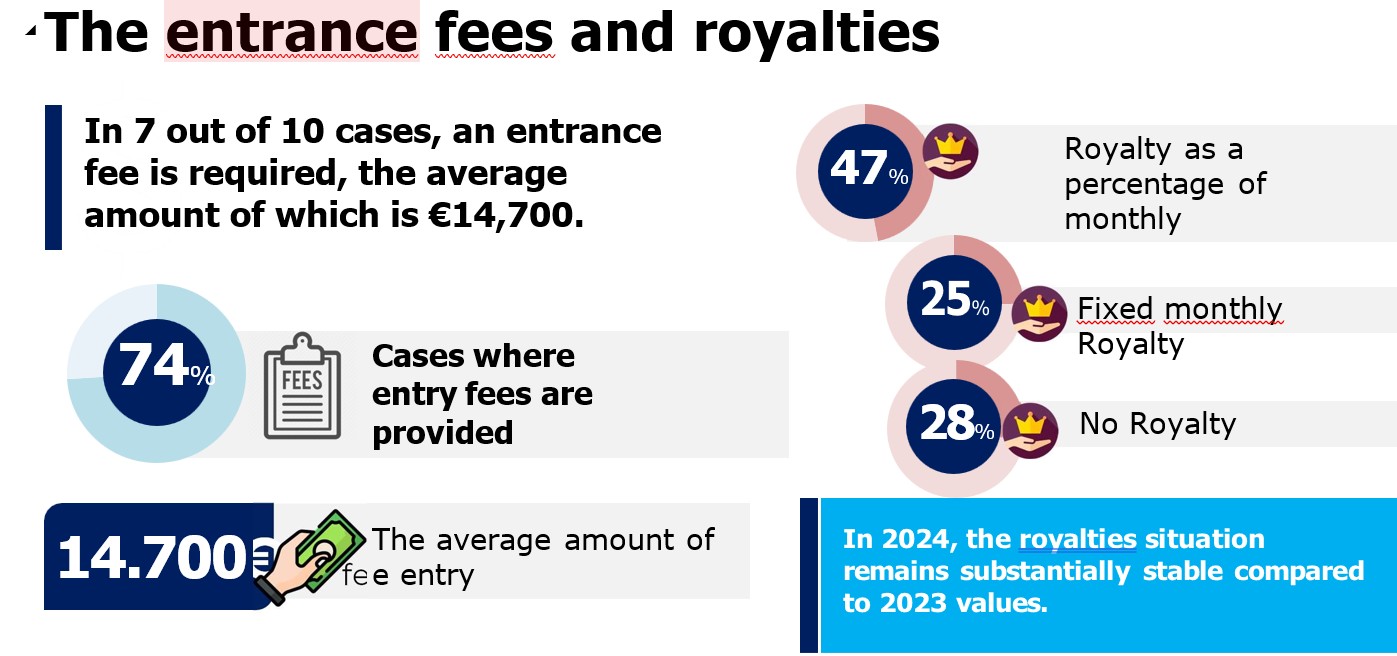

In 70% of cases, franchise agreements provide that an entry fee is due, with an average amount of €. 15,770.

8 out of 10 franchise chains have multi-affiliates, i.e. franchisees with the right to operate with more than one unit or point of sale within a pre-established area.

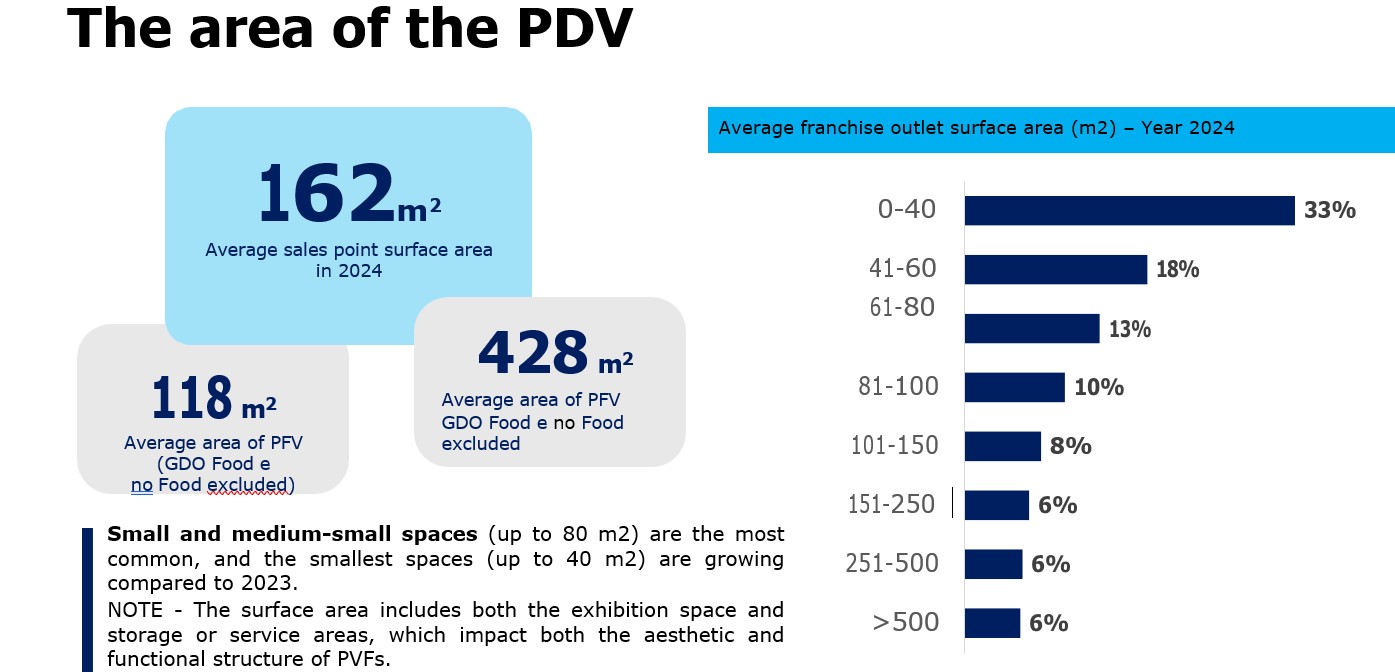

Small and medium-small store surfaces (up to 80 m2) are the most widespread and the smallest (up to 40 m2) are growing compared to 2022. In the next three years, 97% of the franchisors foresee to open new points of sale.

Avv. Valerio Pandolfini

For other in-depth articles on issues relating to franchising: visit our blog.

The information contained in this article is of a general nature and is not to be considered an exhaustive examination of the various issues, nor is it intended to express an opinion or provide legal advice. Specific legal advice must be provided with regard to individual cases.