Franchising in Italy: the 2020 scenario after the Covid 19 pandemic is surprisingly (or not?) positive

Assofranchising (the main Italian franchising association) has recently issued its yearly updated survey on the Italian franchising scenario, referred to the year 2020. This issue of the Assofranchising yearly report is particularly import, since it contains a detailed picture of the Italian franchising sector, from an industry, merchandise and geographical point of view, registering the impact of the Covid-19 pandemic. Notwithstanding the inevitable negative effects of the pandemic, franchising confirms to be in Italy franchising one of the main driver of the Italian economy, being one of the sectors reacting more positively to the economic crisis. In fact, while there was a 10,5% drop in terms of number of active franchise chains in Italy, mainly regarding smaller and less structured networks, all other indicators show a positive trend compared to the previous year; in particular, the total turnover in the franchising sector records an increase, as well as the number of franchise stores and the number of workers employed in the franchise networks. These data are very important, given the large number of the franchise point of sale that have been locked-down due the governmental restriction measures for Coronavirus in Italy, and reflect the proactive approach of the majority of the franchisors in Italy vis a vis the pandemic and the relationship with the franchisees within the network.

1.In 2020 franchising has further grown in Italy, according to the 2021 Assofranchising survey

Assofranchising (the main Italian franchising association), has recently issued 2021 survey, referred to the year 2020. This issue of the Assofranchising yearly report is particularly important, since it contains a detailed picture of the Italian franchising sector, from an industry, merchandise and geographical point of view, registering the impact of the Covid-19 pandemic.

Franchising has been constantly developing in Italy over the last 30 years, and is increasingly becoming a profitable investment, also for foreign franchisors. During 2019 the franchising sector recorded a 4,4% increase, compared to 2018.

The Covid-19 pandemic has inevitably had a negative impact on the franchising sector – as well as on all economic sectors – abruptly interrupting this positive trend. In fact, according to the Assofranchising survey, in 2020 there was a 10,5% drop in terms of number of active franchise chains in Italy, mainly regarding smaller and less structured networks.

Quite remarkably, however, all other indicators show a positive trend compared to the previous year; in particular, the total turnover in the franchising sector records a 3,5% increase, as well as the number of franchise stores (729 new stores were opened in 2020) and the number of workers employed in the franchise networks (10,436 new jobs were created in 2020).

Considering the large number of franchise points of sale that have been locked-down for a considerable amount of time, due the governmental restriction measures in Italy, these data clearly show that franchising is one of the sectors that reacted more positively to the economic crisis, confirming to be healthy and one of the main drivers of the Italian economy.

This in turn reflects the proactive approach of the majority of the franchisors in Italy vis a vis the pandemic and the relationship with the franchisees within the franchise networks.

In fact, the Covid-19 epidemic, although it has been impacting deeply all sectors and activities also in Italy (as well as all over the world), is having a limited effect on franchises, compared to other commercial activities, given the features of the franchising model that make it easier for franchisees – rather than other independent entrepreneurs – to face the effects of such crisis.

After all, these positive numbers, and in particular the turnover increase data, regarding franchising in Italy are not surprising, for number of reasons:

- franchising, being a model based on cooperation and risk-sharing, has a stable advantage over other business models in market competition

- Italy represents an important world market, with nearly 60 million people, most of whom have a high standard of living compared to many other countries;

- in Italy, franchising has grown relatively later than other countries; being relatively new, there are wide market possibilities and, therefore, huge investment opportunities, also for foreign franchises, in a wide range of different commercial activities and services (such as food&beverage, health, education, fitness, etc.);

2.Franchising in Italy withstanded the impact of the 2020 Coronavirus epidemic

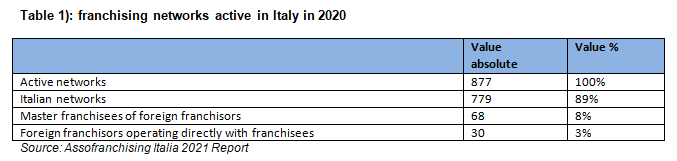

As shown in the following table 1), in 2020 there were in Italy 877 franchise networks, decreased of 103 units compared to 2019. The overall impact of the Covid pandemic in the Italian franchise sector can be therefore evaluated in terms of a 10,5% drop in terms of number of franchise chains, mainly regarding smaller and less structured networks. It is important to underline that only “active” Italian franchise networks have been considered by the Assofranchising survey, meaning chains containing at least 3 point of sales, including direct and franchised.

Of the total existing networks, 89% were born in Italy, while 11% are foreign networks. Out of this percentage, 8% of foreign franchise brands are active in Italy through Italian Master franchisees, while the remaining 3% by operate directly with Italian franchisees.

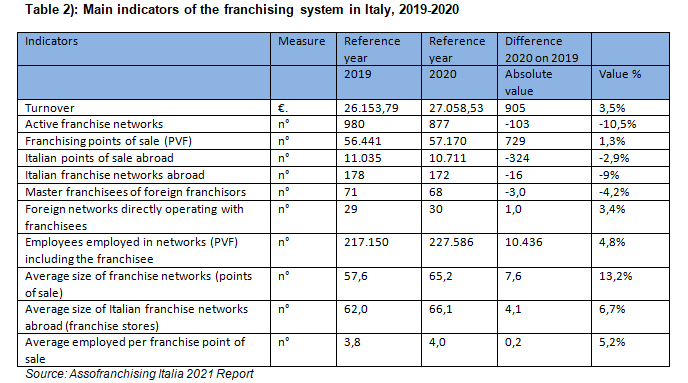

Although 2020 registers an inevitable decrease in terms of number of active franchise networks, due to the heavy impact of the Coronavirus crisis’ effects – considering that 2019, recorded a 4,4% increase, compared to 2018 – all other indicators show a positive trend compared to the previous year; in particular, the total turnover in the franchising sector records a 3,5% increase (+ 3,5% compared to 2019), as well as the number of franchise stores (729 new franchise stores were opened in 2020) and the number of workers employed in the franchise networks (10.436 new jobs were created in 2020).

These data appear to be very important, given the large number of franchise points of sale that have been locked-down for a considerable amount of time, due the governmental restriction measures in Italy during 2020, and reflect the proactive approach of the majority of the franchisors in Italy vis a vis the pandemic and the relationship with the franchisees within the networks.

Therefore, notwithstanding the inevitable negative effects of the pandemic, franchising confirms to be in Italy one of the main drivers of the Italian economy, being one of the sectors reacting more positively to the economic crisis and consolidating as one of the best formula for trade in the Italian market.

As shown by the following table 2), the franchise networks’ turnover in 2020 amounted to €. 27.058,53, increased of 3,5% compared to the previous year. The number of the franchise points of sale in Italy is also growing (+ 1,3%), while those opened abroad has decreased (- 2,9%). The number of employees in the Italian franchising system is also growing, notwithstanding the pandemic (+ 4,8%), as well as the average number of employees per point of sale (+ 13,2%).

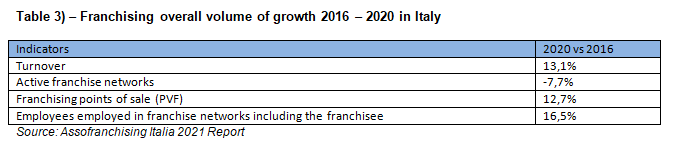

Table no. 3) shows how franchising in the last five years in Italy, notwithstanding the pandemic crisis, has consolidated the indicators in terms of turnover (+ 13,1%), points of sale (+ 12.7%) and employment flow generated (+ 16,5%), while there are negative data on the number of operating brands, signing a decrease by 7,7% due to the Covid-19.

3.Geographical distribution of franchising in Italy

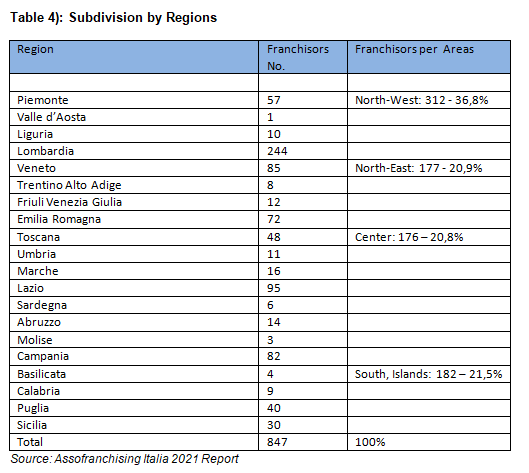

Analyzing the distribution of franchising in Italy from a geographical point of view, the Italian territory can be divided into four macro-areas:

- North-West Italy, where most of the franchisors are concentrated at national level (312, 8%), even if with a lower percentage compared to 2019;

- North-East Italy, with 177 brands (9% of the total number of franchise brands in Italy);

- Center Italy, with 176 franchisors (20,8% of the total franchise stores in Italy);

- South-Islands Italy, last in the standings with 182 franchisors, equal to 5% of the overall franchise brands in Italy (percentage up on 2019).

As shown by table 4), the Italian regions hosting the largest number of franchisors are Lombardy (244) and Lazio (95), followed by Veneto (85), Campania (82) and Emilia Romagna (72).

The following table 5) shows the total franchise points of sale In Italy, divided by single region. Lazio has the highest number of franchise stores (9.576), followed by Lombardy (9.340) and, far back, Sicily (5165), that, compared to other regions, records the largest percentage increase from 2019 (+ 3,9%). The Southern area of Italy is the first in terms of number of stores (18.081, up by + 1,6% compared to 2019).

In terms of profitability, even in 2020 the South area generates the best result, for a total of €. 8,371.389,644 followed by the North-West area which in the same period produced €. 7.884.277,061; the Center and the North-East are placed immediately after, registering however a very high incidence on total production.

4.Franchising in Italy: description of the different production sectors

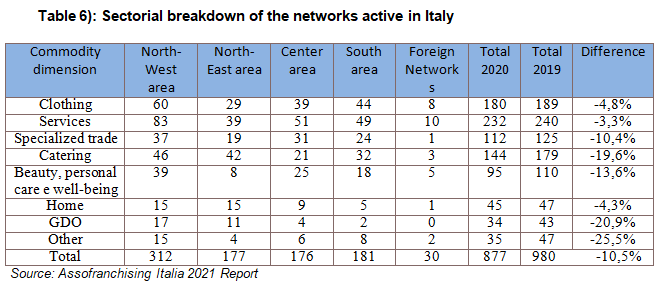

The following table 6) indicates the breakdown by macro-product sectors of the franchisors and the relative distribution by Area in Italy. The table shows that:

- The Clothing sector, that occupies 20.5%, suffers a low drop with a total of 180 active networks compared to 189 in 2019 (-4.8%), of which more than 33% are located in the North-West area;

- the Services sector, constituting 26.5% of the total franchise brands in Italy, records the best performance in 2020, being the sector that overall has suffered less the legislative restrictions imposed by the government to address the pandemic;.

- the specialized trade sector records a significant drop 0f -10,4%, with a total of 112 active networks compared to 125 in 2019;

- the Catering sector has been most affected by the economic crisis caused by the pandemic, since the active networks decreased by 35 units, a decrease of -19.6%, still being the third in the product breakdown of franchisors with a 16,4% share;

- the Beauty sector, which represents a share of 10,8%, suffered a significant decrease compared to the previous year (-13.6%);

- the Home sector, which represents 5.1%, suffers a limited decrease compared to the previous year, with a total of 45 networks active in the national territory;

- the GDO sector represents only a small portion of the total franchising system (3,9%), but has the greatest impact on the total turnover (33.9%), given that the sum of production between GDO food and non-food large-scale distribution generates over 9 billion euros; in 2020, this sector suffered a significant decline as the number of franchise networks.

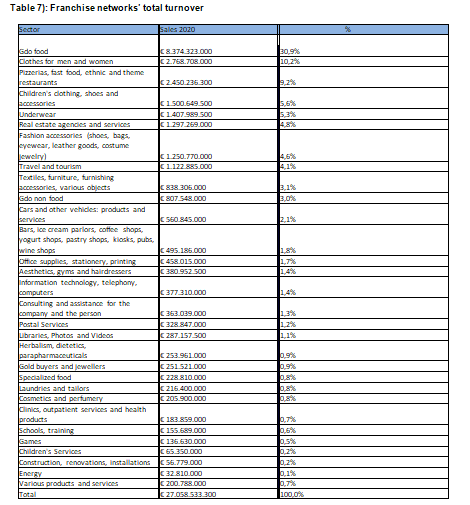

5.Franchise networks’ total turnover

As mentioned, GDO weights 34% of the total franchise turnover. As shown by table 7), compared to 2019, the food large-scale distribution increased + 6.7%, while the non-food large-scale distribution registers a very strong decrease of -45.3%). The “Men’s and women’s clothing” sector follows with a + 55.6% growth compared to 2019, also thanks to e-commerce and protective masks. Pizzerias, fast food, ethnic and themed catering registers a slight decrease of -0.8%. Children’ clothing, shoes and accessories signs an increase of + 16.1%. Compared to 2019, the sector of “Consulting and assistance for businesses and the person” registers an increase of (+ 19.3%),”Laundries and tailors” sector + 61.5%) and the “Games” sector a huge increase of + 116.2%. On the contrary, the sectors “Aesthetics, gyms and hairdressers” and “Travel and tourism” were hit most by the difficult situation that characterized 2020, registering respectively a decrease of -12.6% and 1,5% compared to 2019.

6.Franchisee’s investments, points of sale’ surface, contract duration

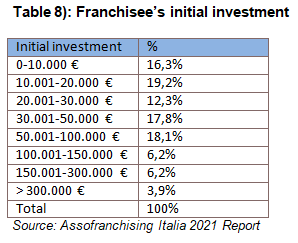

As regards the initial investment that the Franchisee must make to start undertaking the business with the network, table 8) shows a near equity in the percentages of active networks whose initial investment is less than 100,000 euros. Among these, there is a particular concentration in the businesses that require between 10,001-20,000 euros (19.2%) and 50,001-100,000 euros (18,1%).

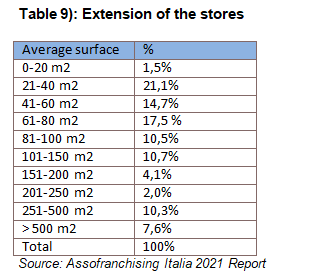

The extension of the surface includes the exhibition area but also warehouse spaces or service rooms, which in any case affect both the aesthetic and functional level of the structure. The points of sale with an area between 0-20 m2 are those that are least present in the franchising system (1,5%). Small surfaces (between 21 and 60 m2) are the most widespread, while surfaces 21-40 and 61-80 m2 are growing compared to 2019. On the other hand, the number of points of sale between 81 and 100 m2 decrease, passing from 12,3% to 10,5%. Full data are shown in Table 9).

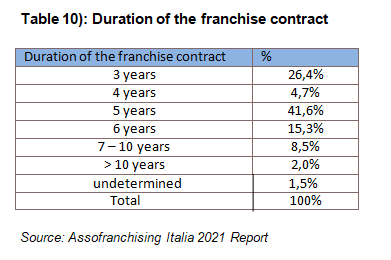

As regards the duration of the franchise contracts in Italy, table 10) shows that in 2020, about 73% of contracts have a duration between 3 and 5 years, a figure substantially unchanged compared to 2019. Contract duration between 7 and 10 years goes from 8% to 8,5%.

Avv. Valerio Pandolfini

For other in-depth articles on issues relating to franchising: visit our blog.

The information contained in this article is of a general nature and is not to be considered an exhaustive examination of the various issues, nor is it intended to express an opinion or provide legal advice. Specific legal advice must be provided with regard to individual cases.